A Bitcoin ETF that trades only while Wall Street sleeps

Tidal Trust II has filed with the US Securities and Exchange Commission for an unusual Bitcoin ETF. The fund, called the Nicholas Bitcoin and Treasuries AfterDark ETF, will buy Bitcoin exposure only when US markets close. It then sells those positions when trading opens the next morning, effectively holding Bitcoin overnight only. During daytime US trading hours, the fund shifts assets into short-term US Treasuries and money market funds instead. This strategy targets a well-documented pattern. Data shows that Bitcoin tends to gain more during non-US trading hours than during the daytime.

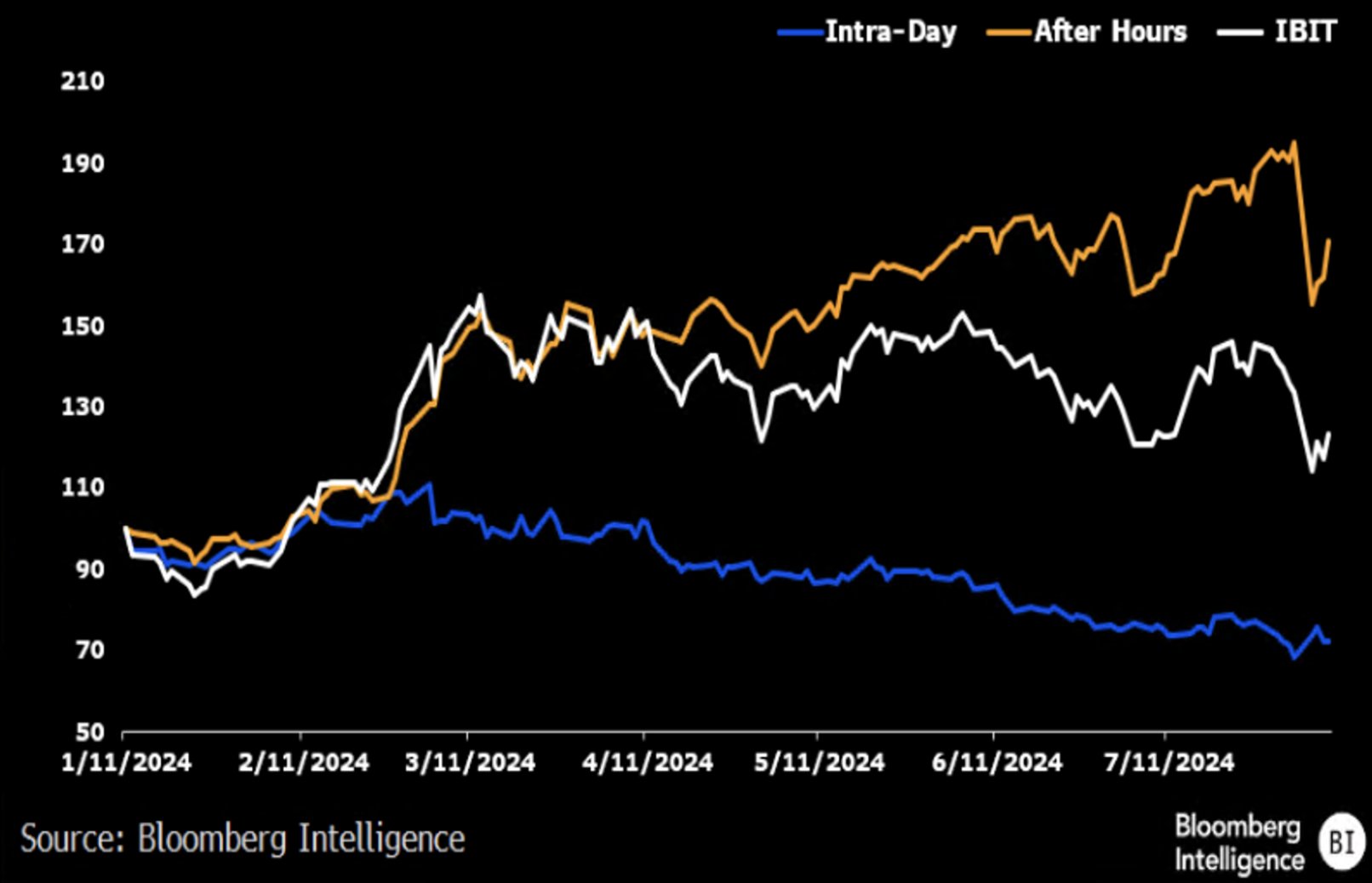

Bloomberg ETF analyst Eric Balchunas noted that his team examined this concept and found most Bitcoin gains happen after hours. The overnight period often sees higher activity in Asian and European markets, where crypto liquidity remains strong. The ETF will not hold Bitcoin directly as an asset like traditional spot Bitcoin ETFs do. Instead, it gains exposure through Bitcoin futures contracts, spot Bitcoin ETF shares, or index-linked options. This structure lets the fund enter and exit positions quickly around market open and close times.

Why this timing-based strategy could work

The « After Dark » approach is built on research showing disproportionate upside when US equity markets are offline. Bitcoin trades around the clock, so significant price action happens between 4pm ET and 9:30am ET the next day. During those hours, Asian traders, European morning sessions, and global institutional flows drive the market without US influence. By holding Bitcoin only overnight, the ETF aims to capture this specific return pattern. During the day, parking capital in Treasuries provides yield and avoids intraday volatility that often erases overnight gains.

If approved, this fund would represent one of the most specialised timing strategies in the Bitcoin ETF landscape. For investors, it offers a way to bet on Bitcoin without full 24-hour exposure to price swings. Balchunas believes the « AfterDark » ETF could deliver better returns than traditional Bitcoin ETFs if overnight patterns persist. However, the fund still requires SEC approval, and neither the SEC nor the CFTC has endorsed it yet.