Bitcoin could (eventually) reach $200k

Industry analysts make predictions about Bitcoin reaching between $150,000 and $200,000 during early 2026 driven by institutional demand. Investment firm Bernstein projects Bitcoin hitting $200,000 specifically due to exchange-traded fund inflows and institutional buying pressure. Options markets linked to BlackRock’s Bitcoin ETF expect prices around $174,000 by 2026 based on current trading patterns. Some optimistic forecasters like crypto analyst Vibes predict Bitcoin could even reach $300,000 if liquidity conditions improve dramatically. ETFs are investment funds that trade on stock exchanges, allowing traditional investors to buy Bitcoin exposure without owning coins directly.Bitwise analysts predict ETFs will purchase more than 100 percent of new Bitcoin, Ethereum and Solana supply in 2026.

This means institutional demand will exceed the amount of new cryptocurrency created through mining and network rewards. The increased institutional participation creates supply shortages that typically push prices higher over time through basic economics. Bitwise also predicts Bitcoin will become less volatile than technology stocks like Nvidia during 2026. Half of Ivy League university endowments may invest in cryptocurrency for the first time according to industry predictions. More than 100 cryptocurrency-linked ETFs could launch in the United States alone during the year ahead. These developments suggest cryptocurrency is transitioning from speculative asset to mainstream institutional investment during 2026.

Stablecoins and RWA enter mainstream finance

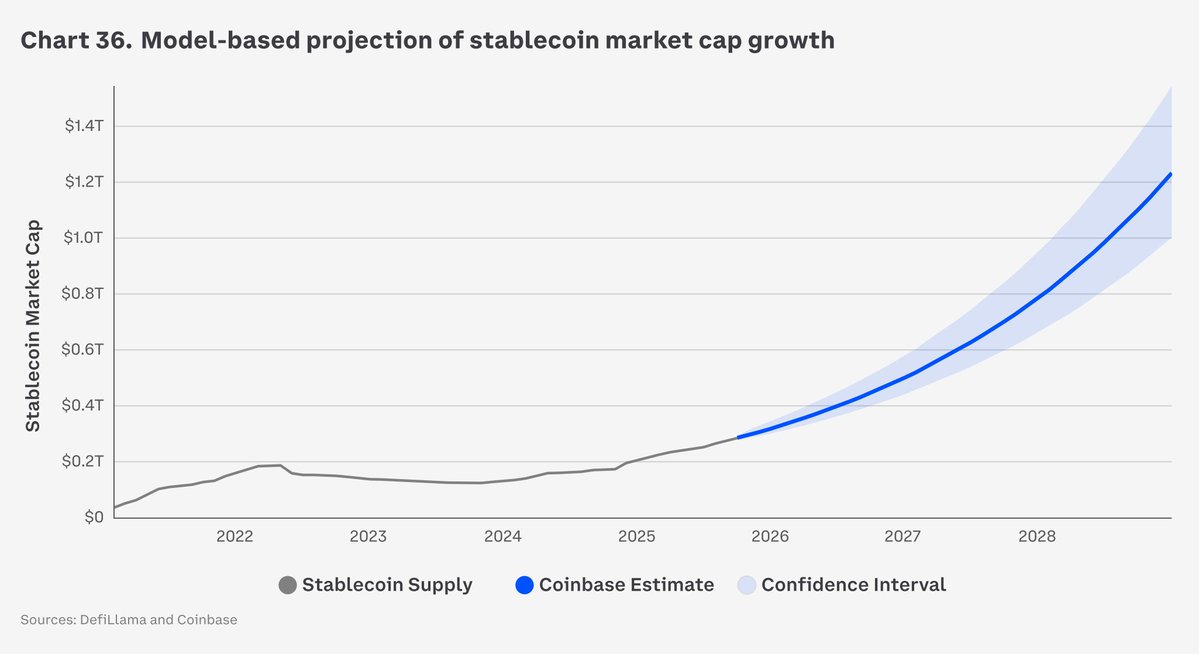

Stablecoins are expected to surge in adoption throughout 2026 as businesses embrace them for everyday payments and settlements. Consulting firm McKinsey predicts stablecoin transactions could surpass traditional payment transactions within a decade from now. The stablecoin market could expand from $250 billion today to $2 trillion by 2028 according to McKinsey’s analysis. USDC and USDT stablecoins will appear in payment processors, corporate treasuries and cross-border settlement systems beyond just cryptocurrency exchanges. For businesses, stablecoins offer instant settlement without delays or costs associated with traditional international wire transfers. Bitwise analysts controversially predict stablecoins will be blamed for destabilising an emerging market currency during 2026. This reflects concerns about stablecoins undermining weak national currencies in developing countries experiencing economic instability.

Tokenised real-world assets (RWA) represent another major trend, with forecasts predicting $30 billion in value by 2026. Real-world assets include traditional investments like corporate bonds, real estate properties and luxury goods converted into blockchain tokens. Giants like BlackRock will make these tokenised assets accessible at scale, enabling fractional ownership of expensive illiquid investments. This allows ordinary people to own small portions of commercial real estate or corporate bonds previously restricted to wealthy investors.

Layer 2 and regulatory clarity accelerate adoption

Advanced Layer 2 scaling solutions will dramatically improve blockchain transaction speeds and reduce costs during 2026. Technologies like zero-knowledge rollups and optimistic rollups will become widely adopted, making cryptocurrency apps faster and cheaper for everyone. These improvements could push decentralised finance total value locked to $1 trillion from roughly $21 billion today. Traditional banks may begin integrating their systems with decentralised finance protocols during 2026 for improved efficiency. Artificial intelligence integration with blockchain technology will enhance trading efficiency and automate complex financial operations. Regulatory clarity represents perhaps the most important development, especially if America passes the CLARITY Act legislation. President Trump’s administration is expected to roll back cryptocurrency enforcement actions and provide clear tax guidance. The government may even establish a national Bitcoin reserve as part of strategic cryptocurrency adoption policies. Clear regulations should stimulate trust in cryptocurrency backed by expanded stablecoin payments and mainstream banking connections. These combined factors position 2026 as potentially the most transformative year in cryptocurrency history for mainstream adoption globally.